Paystubs play a crucial role in the employer-employee relationship, serving as a tangible record of an individual’s earnings and deductions. These documents provide transparency and clarity regarding the financial aspects of employment. In this article, we will delve into the essential components of a paystub and explore the convenience of paystub templates.

Components of a Paystub:

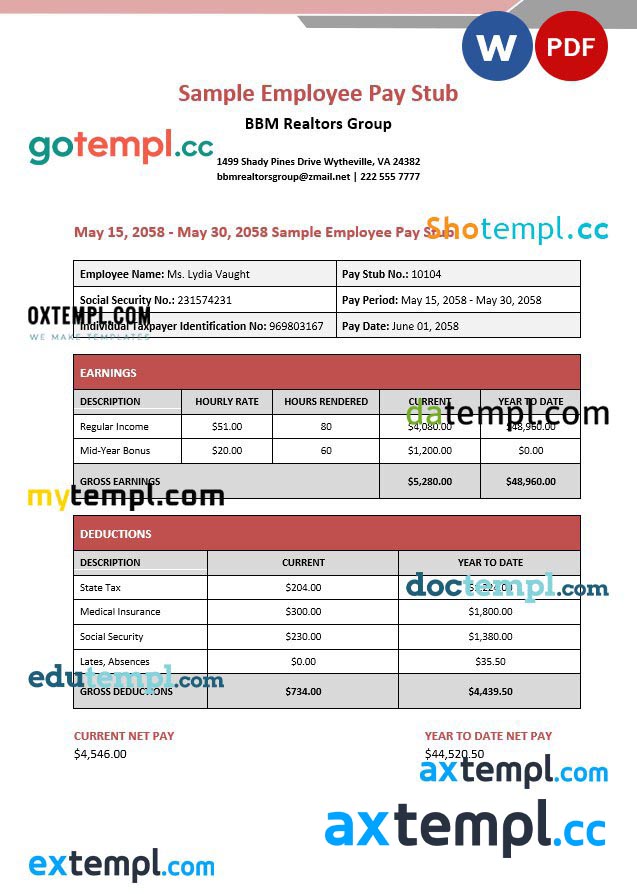

- Employee Information:

- At the top of the paystub, you’ll find basic information about the employee, including their name, address, and sometimes their Social Security number.

2. Employer Information:

- This section includes details about the employer, such as the company name, address, and federal employer identification number (FEIN).

3. Earnings:

- The earnings section outlines the various sources of income, including regular wages, overtime, bonuses, and commissions.

4. Deductions:

- Deductions encompass various items such as taxes (federal, state, and local), Social Security, Medicare, and any voluntary deductions like health insurance or retirement contributions.

5. Net Pay:

- Net pay is the amount the employee takes home after all deductions. It’s the actual money deposited into the employee’s bank account.

6. Year-to-Date (YTD) Information:

- This part of the paystub provides a snapshot of the employee’s total earnings and deductions from the beginning of the calendar year to the current pay period.

7. Pay Period Information:

- Details about the pay period, including the start and end dates, are usually included to provide clarity on which time frame the paystub covers.

Paystub templates:

Creating paystubs from scratch can be time-consuming, and mistakes may lead to confusion or legal issues. Paystub templates offer a practical solution by providing a standardized format that includes all the necessary elements. Here are some advantages of using paystub templates:

- Efficiency:

- Templates save time and effort, allowing businesses to generate paystubs quickly and accurately. This is particularly beneficial for companies with a high volume of employees.

2. Consistency:

- Using templates ensures that each paystub adheres to a consistent format. This consistency helps in reducing errors and makes it easier for both employers and employees to understand the information presented.

3. Legal Compliance:

- Paystub templates are designed to meet legal requirements, ensuring that all necessary information is included. This helps businesses stay compliant with labor laws and regulations.

4. Customization:

- Many paystub templates are customizable, allowing businesses to include specific details relevant to their industry or company policies.

5. Professional Appearance:

- A well-designed paystub template contributes to a professional appearance for the business. This attention to detail reflects positively on the employer-employee relationship.

Paystubs are indispensable tools for employees and employers alike, providing a transparent and detailed breakdown of financial transactions. By utilizing paystub templates, businesses can streamline their payroll processes, enhance accuracy, and maintain legal compliance. As technology continues to advance, digital paystubs and online templates are becoming increasingly popular, further simplifying the payroll process for modern businesses.